The Power of Trading Signals

- July 5, 2024

- #tradingsolutions

In the vast and dynamic realm of financial markets, trading signals act as guiding lights for investors, showing potential opportunities and mitigating risks. Understanding and leveraging these signals can lead traders to trading success and enrich their experience.

What are Trading Signals?

Trading signals are indicators or triggers derived from various analyses that guide investors in making informed decisions about buying, selling, or holding financial instruments such as stocks, currencies, or commodities.

They serve as a roadmap, helping traders navigate through the complexities of the market landscape. Signals show traders recommendations or ideas on specific financial assets, indicating when to execute trades at predetermined price levels and times.

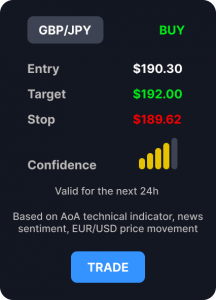

As an example, this is what trading signals look like:

You see the name of asset, the direction – buy or sell, confidence level, entry, stop loss and take profit.

Types of Trading Signals

There are several types of trading signals based on the type of covered assets, the way the signals are generated and so on.

- Manual vs Automated. Manual signals are generated by human analysts based on their expertise and market insights, while automated signals are generated by coded algorithms programmed to monitor and analyze vast amounts of data.

- Paid vs Free. Some signals are provided by paid subscription services offering in-depth analysis and insights, while others are freely available but may lack the same level of detail or accuracy.

- Signals can be tailored to specific financial instruments like stocks, forex, or commodities that require unique analysis methods .

- Technical vs Fundamental vs Sentiment Indicators. The classification is based on the analysis method that was applied during the data study. Technical signals are derived from price charts and mathematical indicators, fundamental signals stem from economic data and company fundamentals, while sentiment indicators gauge market sentiment through factors like news sentiment or social media activity.

How To Use Trading Signals

Trading signals, specifically tailored to the foreign exchange market, are crucial tools for traders. They are generated through a thorough analysis of assets and market trends. Therefore, they offer a range of benefits to traders of all levels of experience.

For beginners, signals provide an opportunity to potentially generate profits while learning about the financial markets as they give valuable insights into the trading world. For experienced traders, signals give an opportunity to leverage them in order to broaden trader’s trading portfolio and enhance profitability.

Numerous platforms and services provide trading signals, catering to traders of all levels. These range from individual analysts and signal providers to advanced data analytics firms employing machine learning algorithms to generate precise signals. In order to get a profit from trading signals trader must choose both a good broker and a good signal provider (for example, Acuity Trading, Tipranks, etc.). It may be useful for traders to learn about provider’s trading performances and strategies, try free trial and test providers on a demo account.

So, trading signals are indispensable tools for investors navigating the intricacies of financial markets. Understanding the types of signals, their usage, and the available resources is paramount for success in trading. Whether manual or automated, paid or free trading signals empower investors with valuable insights, guiding them towards profitable opportunities while mitigating risks. Leveraging these signals effectively can unlock the full potential of trading strategies, leading to sustained success in the ever-evolving world of finance.

Contact Us

Send us a message and we’ll get back to you within 1 business days!