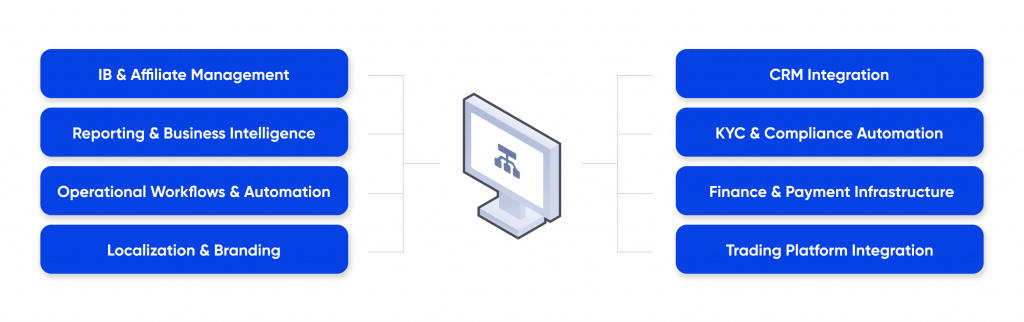

Components of a Back-Office System for Forex Brokers

In the world of Forex brokerage, the back office is not merely an administrative layer — it is the operational backbone that ensures the brokerage functions smoothly, efficiently, and in full regulatory compliance. While front-end platforms facilitate trading, it is the back-office infrastructure that powers everything happening behind the scenes — from client onboarding to payout processing.

Below is a detailed breakdown of the core components that form a robust, scalable, and regulation-ready back-office system for Forex brokers.

1. Client Management (CRM Integration)

At the heart of a modern back-office system lies the Client Relationship Management (CRM) module. This component is responsible for maintaining client data, managing sales pipelines, and ensuring efficient communication.

- Client onboarding with KYC document collection and verification

- Tiered account types, user segmentation, and profiling

- Lead management with automated assignment rules

- IB (Introducing Broker) and referral tracking

- Support for sales and retention workflows

CRM is a software system that centralizes customer data and interactions, providing visibility across the entire client lifecycle.

2. KYC & Compliance Automation

In a heavily regulated industry like Forex, compliance is mandatory. A back-office system must automate and enforce regulatory standards across jurisdictions.

Capabilities include:

- Automated KYC (Know Your Customer) and document verification

- Expiry alerts for time-bound documentation

- Integration with AML (Anti-Money Laundering) and PEP (Politically Exposed Persons) screening tools

- Comprehensive audit logs for internal and external reviews

- Support for region-specific onboarding workflows (e.g., CySEC, FCA, ASIC, MAS)

This ensures operational transparency and minimizes the risk of non-compliance penalties.

3. Finance & Payment Infrastructure

The financial layer of a back-office system manages all client-facing and internal financial operations, directly influencing user trust and retention. Efficient financial flows lead to higher client satisfaction and fewer support tickets.

Essential functions include:

- Deposit and withdrawal processing

- Integration with Payment Service Providers (PSPs)

- Multi-currency wallet management

- Real-time transaction monitoring for fraud prevention

- Reconciliation tools and access to historical payment logs

4. Trading Platform Integration

A back-office system must interface smoothly with trading platform. It ensures that client trades, account stats, and broker-side data stay in sync — a critical factor in compliance and dispute resolution.

Required capabilities:

- Real-time data synchronization (trades, balances, equity, margin)

- Monitoring of leverage usage and margin calls

- Access to full order history and trade reports

- Tools for risk exposure analysis

5. IB & Affiliate Management

Many Forex brokers grow by partnering with Introducing Brokers (IBs) and affiliate marketers. A dedicated partner management module is crucial for scalable and transparent collaboration.

Must-have features:

- Multi-tier IB structures

- Real-time commission tracking with customizable payout rules

- Dedicated IB portal with client assignment and campaign tracking

- Transparent reporting tools for all stakeholders

6. Reporting & Business Intelligence

Informed decisions require timely and structured data. A robust back-office system enables:

- Customizable reporting on trading activity, deposits/withdrawals, and user behavior

KPI dashboards for performance metrics (sales, retention, compliance) - Scheduled reports (daily/weekly/monthly)

- Export-ready data formats for audits and tax filings

Business Intelligence (BI) refers to tools that convert raw data into actionable insights through analytics and visualization.

7. Operational Workflows & Automation

Automation streamlines operations and reduces the risk of human error. Also, it frees up human resources for value-adding tasks and ensures consistency across processes. Modern back-office systems offer:

- Trigger-based task assignment (e.g., for pending KYC or failed transactions)

- System alerts for anomalies like margin calls or document expiry

- Approval workflows for manual fund movements

- Webhook/API support for integrating with third-party tools (e.g., email systems, risk engines)

8. Localization, Branding & Multi-Entity Support

As brokerages scale globally, they must support multiple regions, brands, and regulatory frameworks within one system.

Critical capabilities:

- Brand-specific portals with unique UI/UX

- Multi-language interfaces for global accessibility

- Isolated data environments for each jurisdiction

- Country-specific reporting and tax compliance tools

A powerful back-office system is not a luxury — it’s a necessity for any Forex broker aiming for sustainable growth and regulatory success. It is the silent engine that enables speed, security, and scale across the brokerage.

When selecting a solution, focus not just on dashboards or visuals, but on:

- Modular architecture

- Compliance readiness

- Workflow automation

- Ecosystem integrations

A well-designed back-office ensures that while your traders enjoy a seamless front-end experience, your team benefits from structure, control, and strategic insight.

Have questions about implementing or choosing a back-office solution for your brokerage? We are always open to sharing insights or exploring collaboration.